B.C. Loan Forgiveness Program

Recent graduates in select in-demand occupations can have their B.C. student loans forgiven by agreeing to work at publicly-funded facilities in underserved communities in B.C., or working with children in occupations where there is an identified shortage in B.C.

What is available?

If you qualify for the B.C. Loan Forgiveness Program, the Province of British Columbia will forgive the outstanding B.C. portion of your Canada-B.C. integrated student loan debt at a rate of up to a maximum of 20% per year for up to five years.

If you complete five years of employment, all or a percentage of your B.C. student loan debt will be forgiven.

Am I eligible?

You may be eligible if you:

- are in repayment of an outstanding B.C. student loan (not restricted in default, delinquent or bankruptcy)

- have graduated from an accredited post-secondary educational institution

- are or will be employed (full-time, part-time, and/or casual/on-call) at a publicly funded facility in an eligible occupation either with children or in an underserved community in B.C.

- are not enrolled in full-time post-secondary studies

Notes:

- To receive benefits under this program you will be required to demonstrate a minimum number of in-person hours of service in an eligible occupation at a publicly-funded facility either in an underserved community or working with children (see the What are my responsibilities under this program Section).

Eligible occupations in underserved communities are:

- Nursing (including licensed practical nursing, nurse practitioners, registered psychiatric nurses and registered nurses)

- Physician, including residents

- Midwifery

- Medical laboratory technologist

- Diagnostic medical sonographer

- Speech language pathologist

- Audiologist

- Occupational therapist

- Physiotherapist

- Respiratory Therapist

- Polysomnographer

- Radiation therapist

Eligible occupations working with children throughout B.C. are:

- Speech language pathologist

- Occupational therapist

- Audiologist

- Physiotherapist

- School psychologist

- Technology educator

- Teacher of the deaf/hard of hearing or the visually impaired

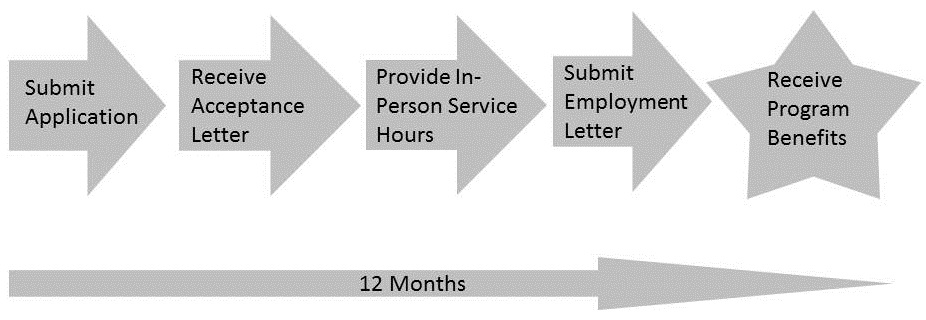

How do I apply?

Instructions

- 1 Ensure you have access to the StudentAid BC Dashboard to receive all notifications and to submit documentation as required. Make sure you supply the same email address for all StudentAid BC program applications. If you are a new applicant, you will need to set up a BC Services Card account to access the StudentAid BC Dashboard.

- 2 Read these instructions and conditions carefully.

- 3 Complete the B.C. Loan Forgiveness Program application, and confirm checklist is complete.

- 4 Submit your application form to StudentAid BC, along with an employment letter. Your employment letter must contain all of the following:

- must be on company letterhead;

- current date (this date must be within one month of the date your application was received at StudentAid BC);

- employer's signature;

- applicant’s name and job title;

- employment status (full-time/part-time/casual on-call);

- hired/start date;

- name of the publicly-funded facility;

- name of the community; and

- whether working with children (for specific occupations).

Please note an employment offer letter does not meet the requirements of an official employment letter.

- 5 Read, sign and date SECTION 2 – Declaration, and return the completed package to StudentAid BC via the document upload option on your StudentAid BC Dashboard.

What are my responsibilities?

Once you have been approved for the B.C. Loan Forgiveness Program, there are things you must do to maintain eligibility:

- One year after your program registration date (your one year anniversary date), you must submit via StudentAid BC online account, mail or courier a signed letter from your employer documenting your hours of in-person service in an eligible occupation at a publicly-funded facility in British Columbia either in an eligible under served community or working with children. The letter must include the following:

- Letterhead and name of the facility where you are employed;

- Your name, occupation and community;

- Dated within 30 days of your 12 month anniversary date;

- Signature of your employer; and,

- The number of in-person service hours provided during the 12-month period prior to the anniversary date.

- Maintain your current mailing and email address information with StudentAid BC.

Note: If your verified in-person hours of service is less than 400 and greater than 99 hours, your benefits under the program for that year will be prorated as indicated below.

| Total Annual Hours of In-Person Service | Annual Percentage of BC Student Loan Debt Forgiveness |

|---|---|

| 0 to 99 | 0% |

| 100 to 249 | 10% |

| 250 to 399 | 15% |

| 400+ | 20% |

Important: If you plan on applying for loan forgiveness, any payments you make prior to your approval for loan forgiveness benefits will not be used in the calculation for eligibility. Therefore, the balance at the date of registration onto the loan forgiveness program will be the balance used for the calculation of benefits.